OP-ED

There are alternatives to permanent economic depression

Judging by the unemployment rate, the level of social unrest and violence in working-class neighbourhoods, or the fact that a quarter of all children below five years have stunted growth, South Africa is in a permanent economic depression, no matter how ‘technical’ or short-lived the present recession is.

In the short term, a slowdown of the world economy has already been noted in the European press. If global demand falls or if US President Donald Trump persists with his imperialist whims, the already depressed South African economy will be badly affected. It is dependent on export of minerals and commodities. President Ramaphosa’s government is reinforcing this with the “New Dawn for Mining” and “export-led growth” policies.

There is also a risk of another global financial meltdown. Nothing substantial has changed in the global financial system since 2008. Total debt in the world is way above the 2008 crash level. According to United Nations Conference on Trade and Development, global debt has soared from $142-trillion to $250-trillion, or three times the combined income of every nation.

Banks are right now telemarketing credit to their customers. You don’t have to apply. They call to say your card is waiting at their local office. If you have one already, they call to say a second credit card is there with your name on it. And if you don’t collect it, they call again to say that they want to increase your limit on the credit card you have. An “authorised financial service provider” never gives up.

In our economic and social powder-keg situation, powerful lobby groups expect and argue for larger quantities of the same economic policy medicine as last year, and the year before and the year before that. The basis of their power, and that of the credit ratings institutes, is the growing indebtedness of government and parastatals to profit-maximising financial institutions.

The government obviously sees no other response to this than cuts in government spending. It is trying to avert a debt crisis by deepening the social crisis. The reallocation character of the R50-billion September package must be seen against this background. Some of the reallocations might be wise, but the goal of the government remains to reduce its spending.

Still, you can only “stimulate” the economy by increasing the buying power of the broad population. The only thing in the R50-billion package directly affecting economic demand is the lifting of the “unabridged birth certificate” requirements placed on foreign tourists; when this actually happens and when it becomes known.

The government couldn’t cut taxes. Debt service costs – the interest on the debt and exchange rate effects – are 13% of tax revenue and rising, from R182-billion in 2018 to an estimated R220-billion in two years. In any event, the damaged SA Revenue Service is already doing this for cigarette smugglers and for corporates paying “management fees” to fictional offices in Dubai or on Cayman Islands.

One of the institutions for which the debt service costs of the public sector in fact are an income is the Public Investment Corporation (PIC). The CEO of PIC reported in March to Parliament that PIC had R2.084-trillion on its books. He was defending PIC at the Standing Committee on Finance against allegations of nepotism and corruption. These allegations will now be investigated by yet another commission.

Let this probe into PIC be a signal to completely change the borrowing regime of the South African government. Albert Einstein allegedly defined madness as repeating the same measures, but expecting different results. A definition of sanity would then read: You have to do something completely different if you want to have something you never had before.

Now, PIC has two main clients. These are the Government Employee Pension Fund (GEPF) and the Unemployment Insurance Fund (UIF). The creditors PIC, GEPF and UIF are, crucially, all government controlled.

GEPF’s assets comprise 87% of this R2-trillion. Through the PIC, in March 2017, GEPF effectively lent the parastatals R163.7-billion. To the government itself, the GEPF had lent R324.7-billion. That is: the government-controlled GEPF has invested R488.4-billion in loans to government and state companies.

But 50% of GEPF’s assets are held in shares. GEPF was good for R1.673-billion in March 2017; 12% of GEPF’s whole financial wealth was shares in Steinhoff and in Naspers (a staggering R164-billion in Naspers, whose shares since have been falling). Steinhoff now sits in the Rogue’s Gallery testifying to the Grand Corruption of the Zuma Presidency. Naspers’ most important company is Tencent – a cellphone game company partnering with the Chinese government to keep political check on the citizens: face-recognition spyware and other niceties.

Another 8% of PIC belongs to the UIF. UIF payments to workers who lost their jobs have been less than the contributions it has received for over two decades. Official unemployment in South Africa stands at 28%, not counting those who gave up looking for jobs. During the rise of mass unemployment, what is supposed to be the workers’ own public unemployment insurance has become an obscene bastion of financial wealth. In March 2017, UIF had hoarded R180-billion in the PIC.

The 2% UIF fee levied on the wage is paid even by the lowest paid formally employed workers (the employers deduct their half from the wage bill as labour cost). This fee is not a part of the government’s budget. When UIF has paid out benefits, the surplus is handed over to PIC. For many years the annual surpluses has been R6- to R8-billion. The rules were just made more liberal. Still, however, the surplus is projected to R2-billion per year.

The increase of VAT to 15% on 1 April put an estimated R23-billion damper on consumption during this budget year. This is a factor behind the recession. If the UIF fee was scrapped for a year or two, the annual fee collection of R22- to R23-billion would add to economic demand, reversing the effect of the VAT increase on all formally employed. Indeed, if they get to hear the news, many informal workers and their families who are victims of a fraudulent UIF deduction from their salaries will also benefit.

Today it would however be necessary to defend such a stimulus measure worthy of the name from the plans of the South African Reserve Bank (SARB). SARB is expected to increase interest rates in 2018, to defend the value of the rand. The idea is that this will stop price increases on imported goods, such as oil. Anyone with a loan or a credit card from a bank or a retailer will then see a cut in buying power. Higher interest rates also increase the government’s debt service costs. The government will be fighting the debt crisis and the recession and the SARB will work in the complete opposite direction. Household debt is over R1.7-trillion. A quarter percent interest rate increase will suck R5-billion into the financial system and away from consumers.

The neoliberal idea of an independent central bank must fall. The SARB must co-operate with the government. This is a more urgent issue than SARB being “private”.

China uses exchange controls, instead of interest rates, to set a certain value of the Yuan – to Donald Trump’s dismay. South Africa should do something similar, and it could do this if the state borrowing regime is changed along the lines here suggested.

What would such a change look like? One interesting suggestion was to convert the R84-billion in loans from the GEPF to Eskom into shares that pay no dividends. That would remove interest payments on the R84-billion. This was disregarded for fear of private creditor institutions crying “Eskom is defaulting!”; that is: for the fear of their political power and opinions.

The non-political and rational question is whether GEPF can afford to lose its R5- R10-billion annual interest incomes from Eskom.

The GEPF is a “Defined Benefit” pension fund. The members get what they are entitled to according to the rules, not less and not more. There is no need to maximise the size of the fund. It needs to be big enough to safeguard the pension payments and meet other obligations to members. It could use the rest of the money in the fund to maximise value to society, instead of hoarding it and maximising its returns on investment. This wouldn’t hurt its members.

If we accept this logic, GEPF should lend most of its funds to government. The most important reason for this is to stop budget austerity motivated by rising debt service costs.

GEPF has in fact already lent the government R324-billion, Eskom R84-billion and Transnet R25-billion (March 2017). We can only guess that the government right now pays an interest of between 6% and 9%. GEPF’s holding of government and parastatal bonds should mean it earns between R20-billion and R30-billion per year in interest income from the public debt.

GEPF’s annual surpluses has been about R50-billion. Even if GEPF were to give the government and parastatals an interest moratorium, it would today still harvest a surplus of between R20-billion and R30-billion per year.

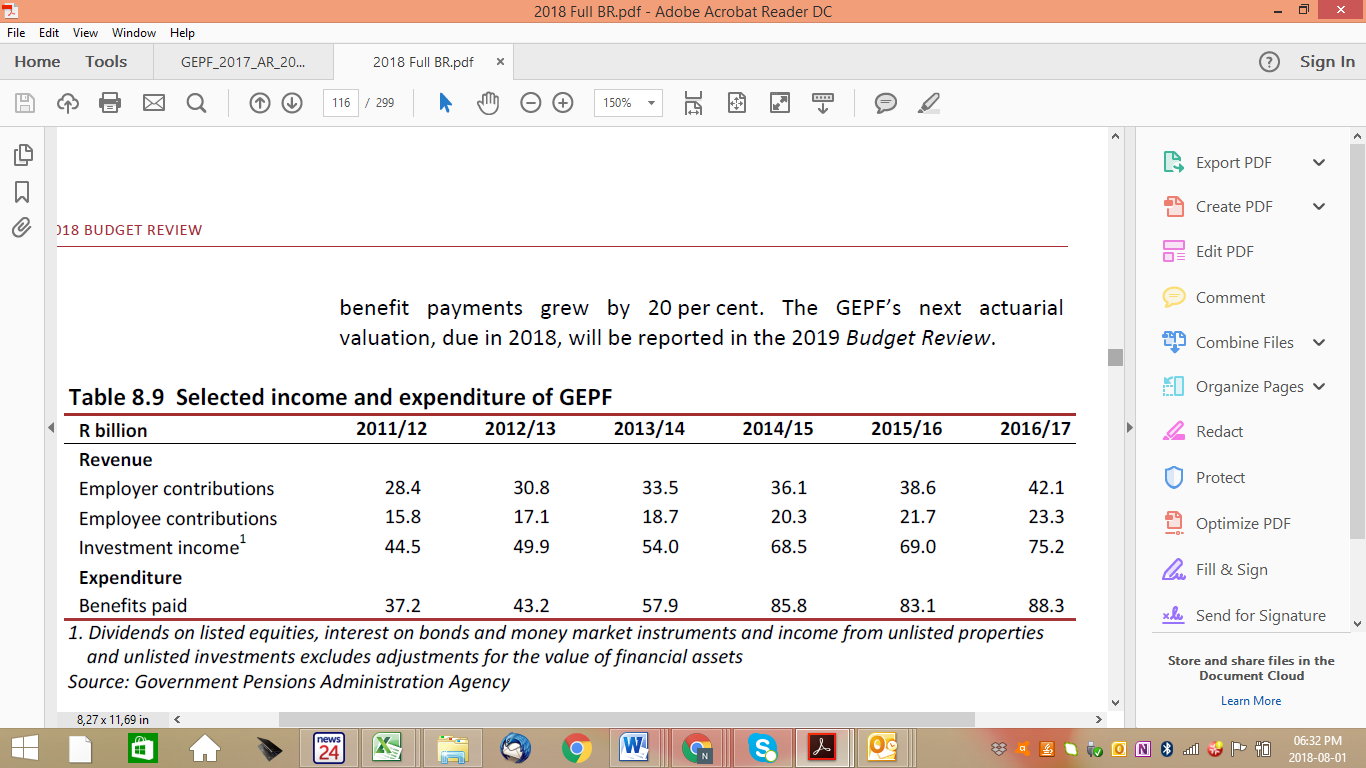

The 2017 and 2018 Budget Reviews and the 2017 annual report of GEPF show that the annual rate of return on GEPF’s investments has been around 4.5%, for 10 successive years. We measure this like Treasury measure it, without considering the erratic market value changes of shares and bonds. Compared to the GEPF’s 4.5% income from its investments, the government is paying an average of 6.5% per year on its R2.8-trillion debt, according to the 2018 Budget Review.

Second, a change to regulated borrowing from government controlled public funds would safeguard South Africa’s policy independence from the International Monetary Fund, China, or any one of the other creditors who impose conditions on loans and dictate economic policy to safeguard their investments in our debts.

The corrupted deals at Transnet and Eskom amount to tens of billions. Many have argued that the US$3.75-billion loan from the World Bank in 2005 to Eskom’s financially and ecologically disastrous coal adventure at Kusile and Medupi should be regarded as odious debt. It could also very well be argued that a large chunk of the loans from Chinese institutions – to pay for trains, harbour cranes and “facilitation” – should be renegotiated. But this cannot happen if you are asking to borrow R400-billion more from China.

The direct rational for radical change in state borrowing policy remains however this:

Every 0.5 percentage point the government can save in debt service costs would save close to R14-billion per year. A reduction from the 6.5% it is currently paying, to 4.5% if it borrowed from the GEPF, would reduce the debt service cost by R55-billion rand a year.

The GEPF would not lose any income. The pensions of the GEPF pensioners would not be threatened. The only losers from PIC reallocating sizeable investments from shares into public bonds would be the Johannesburg Stock Exchange (JSE) and the capitalists serviced by the PIC’s unlisted investments, which now are coming under scrutiny.

Should one worry? Even after the fall on JSE this year, Johannesburg has one of the most overvalued stock markets in the world. The value of all shares on the JSE is about 300% of South African GDP. As for undermining the BEE investment policy of PIC and GEPF by reallocating funds from venture capital to the public service delivery sector, the project of building a black faction of the crony capitalist class has destroyed and is continuing to destroy the ANC. It is a destructive minority class project.

The winners from the policy change would be the overwhelming majority who are directly dependent on the public service delivery sector. This sector is in need of urgent expansion and insourcing to fight corruption instead of being hit by austerity, looting and cutbacks.

The labour movement and civil society, including the public sector unions that have a say in the running of GEPF, should read their Karl Marx again: “The national debt is the golden chain by which the bourgeoisie controls the state.” Prophetic as he often was, he hadn’t even heard about credit rating agencies.

It is in the interest of the broad masses that the government does as much of its borrowing as possible from funds that are not controlled by the capitalist class and avoids borrowing in foreign currencies.

There is such a fund available in South Africa. It is called the PIC and 95% of its assets belong to two other well-known public funds that don’t need to maximise investment returns.

The investigation of corruption in the PIC should be a signal to completely change the management of public debt in South Africa. There is a solution to the debt crisis and there is no need for austerity. DM

Dick Forslund is senior economist at Alternative Information and Development Centre (AIDC).

Become an Insider

Become an Insider